In June 2025, the GASB published Implementation Guide 2025-1, Implementation Guidance Update—2025 (IGU). The IGU contains 16 new questions and answers (Q&As) and amends two previously issued Q&As. Let’s take a look at the four new Q&As related to GASB Statement No. 100, Accounting Changes and Error Corrections, addressing capitalization thresholds, display requirements, and so-called “ghost columns.”

Question 4.11 – Capitalization Thresholds

- Q—Is a change in a government’s capitalization threshold a change in accounting principle as defined in Statement 100?

- A—No. A capitalization threshold is the application of materiality to a specific asset class, not an accounting principle. Therefore, the requirements of Statement 100 for a change in accounting principle, including the requirement to restate beginning balances, as appropriate, do not apply to that change.

Under paragraph 5 of Statement 100, changes in accounting principle are either (a) a switch from one generally accepted accounting principle to another or (b) the implementation of a new GASB pronouncement. This Q&A states that capitalization thresholds are not accounting principles (i.e., not a provision of GAAP) but, rather, a materiality concept that determines which capital expenditures will be reported as capital assets in the accrual financial statements.

Question 4.12 – Display of Restatements and Adjustments to Beginning Balances

- Q—Can an individual adjustment to or restatement of beginning net position, fund balance, or fund net position be displayed separately from the remaining aggregate of adjustments to or restatements of those beginning balances?

- A—No. Paragraph 31 of Statement 100 requires display of the aggregate of all adjustments and restatements. Accordingly, unless each accounting change and each error correction is separately displayed in the financial statements in accordance with the exception permitted by paragraph 32 of Statement 100 (in addition to the aggregate amount as required by paragraph 31), a single line item presenting the sum of all adjustments to and restatements of beginning balances for each reporting unit should be displayed.

Paragraph 31 of Statement 100 requires that each reporting unit (all columns except totals) in the resource flows statements (such as the government-wide statement of activities) show the aggregate amount of restatements and adjustments to beginning balances for the period. A government may choose to display the individual restatements and adjustments on the face of the financial statements, thereby qualifying for the exemption in the last sentence of paragraph 32 from disaggregating them in a tabular format in notes to financial statements. This Q&A states that display of individual restatements and adjustments on the face of the financial statements is an all-or-nothing provision: Either all restatements and adjustments are displayed separately or they are all shown in the aggregate. A government may not display some individually and aggregate the others.

Question 4.13 – Ghost Columns – Change from Major to Nonmajor Fund

- Q—How should a change in a fund’s presentation from major to nonmajor be displayed in the financial statements?

- A—Paragraph 31 of Statement 100 requires that the aggregate adjustments to and restatements of beginning net position, fund balance, or fund net position, as applicable, be displayed separately by reporting unit. As a result, a column should continue to be presented in the statement of revenues, expenditures, and changes in fund balances or the statement of revenues, expenses, and changes in fund net position, as applicable, that displays (a) the fund’s beginning balance as previously reported in the major column and (b) the adjustment to that balance, even though that column does not present activity for the reporting period. Correspondingly, in the statement of revenues, expenditures, and changes in fund balances or the statement of revenues, expenses, and changes in fund net position, as applicable, the column that presents nonmajor funds in the aggregate also should display the adjustment to its beginning balance.

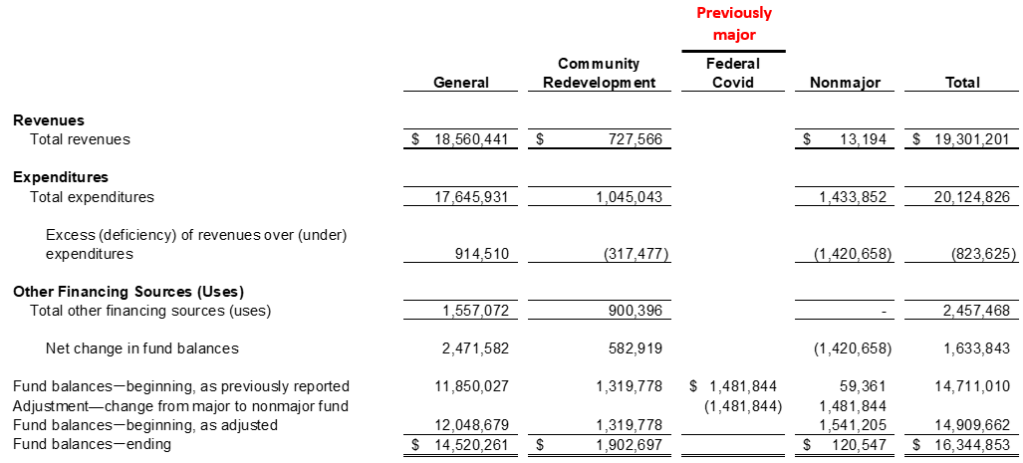

This Q&A addresses the “ghost column” issue that results in the unusual presentation of a nearly empty column in the fund financial statements. Although the previously major fund is now reported within the nonmajor funds column, a government is still required to display the beginning balance as previously reported and the aggregate adjustment to that balance. To accomplish that, the government must continue to present a column for the previously major fund that is empty of activity except for the beginning balance as previously reported and the aggregate adjustment to that balance. The remainder of column should be blank, not zeros or dashes. It would look something like this:

Question 4.14 – Ghost Columns – Movement of Continuing Operations

- Q—Would the answer to Question 4.13 be different if the major fund no longer exists as a result of the movement of continuing operations, for example, a major enterprise fund will be reported as part of the general fund (instead of as a result of a change in fund presentation as described in Question 4.13)?

- A—No. Consistent with the answer in Question 4.13, in the example in this question, a column should continue to be presented in the statement of revenues, expenses, and changes in fund net position that displays (a) the enterprise fund’s beginning balance as previously reported in the major column and (b) the adjustment to that balance, even though that column does not present activity for the reporting period. Correspondingly, in the statement of revenues, expenditures, and changes in fund balances, the column that presents the general fund also should display the adjustment to its beginning balance.

This Q&A clarifies that ghost column reporting is not limited to reclassification of a fund from major to nonmajor. It also may result from the closing of one fund and creation of another as part of moving a continuing operation (e.g., relocating a water utility from an enterprise fund to a special revenue fund). In this instance, a column should continue to be presented for the closed fund that is empty of activity except for the beginning balance as previously reported and the aggregate adjustment to that balance. The remainder of column should be blank, not zeros or dashes.

Leave a comment